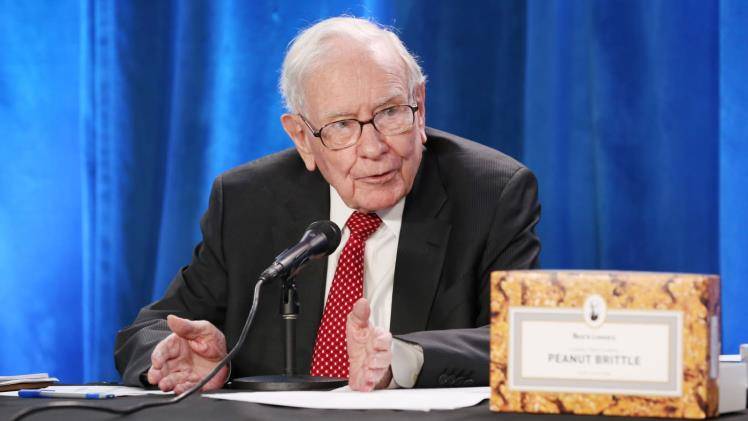

The Warren Buffet portfolio is looked on with envy by investors worldwide, with the man behind it considered a living legend. There are many reasons for this adulation, but perhaps the most important is that his investing strategy has been proven to work time and time again. While there are no guarantees in the world of investing, following in the footsteps of someone like Warren Buffet is as close as you can get to a sure thing.

There are a few key lessons that investors can learn from the Warren Buffet portfolio.

Firstly, it is important to have a diversified mix of investments. This means not putting all of your eggs in one basket and instead spreading your money around to different asset classes and sectors. This diversification helps to protect you from the ups and downs of any one particular investment and has been a key part of WB’s success.

Secondly, it is important to invest for the long term. This may seem like common sense, but it is often forgotten in the heat of the moment when markets are fluctuating, and it can be tempting to try and make a quick profit. However, as the Warren Buffet portfolio has proven time and time again, the best investment decisions are those made with a long-term perspective in mind.

Thirdly, the Warren Buffet portfolio extols the virtues of patience. In today’s fast-paced world, it can be easy to get caught up in the hype of new investment and want to cash in quickly. However, as WB has shown, patience is often rewarded handsomely in the world of investing. By holding onto investments for the long haul, you give them time to grow and compound in value, which can result in some impressive returns further down the line.

Fourth, the Warren Buffet portfolio demonstrates that rebalancing is not always rational. In the world of investing, there is always a temptation to try and time the market by selling when things are going well and buying when prices are low. However, this is not always the best strategy. Sometimes, the best thing to do is simply hold onto your investments and let them ride out the ups and downs of the market.

Firth, the Warren Buffet portfolio highlights the importance of always learning and keeping up to date with the latest investing trends. No matter how successful you are as an investor, there is always room for improvement. By regularly reading about investing and keeping up with the latest news, you can ensure that you are always ahead of the curve and making the best investment decisions possible.

Lastly, it is important to remember that investing is not an exact science. There will be times when even the best-laid plans go awry, and losses are incurred. The key is to learn from these mistakes and to keep on trucking. Like Warren Buffet, the best investors are those who are able to take the bad with the good and keep on chugging along towards their goals.

To summarise, the key lessons that can be learned from the Warren Buffet portfolio are diversification, patience, long-term thinking, and a willingness to learn. These are all qualities that any investor would do well to cultivate if they want to achieve a high level of success.

By following these lessons from the Warren Buffet portfolio, you too can start down the path to investment success. There is no guarantee that you will become the next Warren Buffet, but by following his lead, you can certainly improve your chances. So, what are you waiting for? Start investing today!